Car title loan low-income assistance programs provide a unique and vital resource for communities facing economic downturns, offering quick access to capital using vehicle titles as collateral. This alternative financing method eases financial strain, helping individuals cover unexpected costs or consolidate debt without strict traditional banking criteria. By empowering those with limited incomes and poor credit, these programs foster long-term economic growth through flexible loans that support education, small businesses, and medical expenses, ultimately contributing to community prosperity and self-sufficiency.

Car title loans, a form of secured lending, can offer crucial support to low-income communities during economic downturns. This article explores how these unique financial tools can break down traditional barriers and provide much-needed capital for those struggling. By understanding the mechanics of car title loans and their positive impact on low-income households, we uncover a potential pathway to economic recovery and stability. Discover how assistance programs targeted at this demographic can foster a more resilient and prosperous future.

- Understanding Car Title Loans and Their Impact on Low-Income Communities

- The Role of Low-Income Assistance Programs in Economic Recovery

- How Car Title Loan Support Can Drive Positive Change and Financial Stability

Understanding Car Title Loans and Their Impact on Low-Income Communities

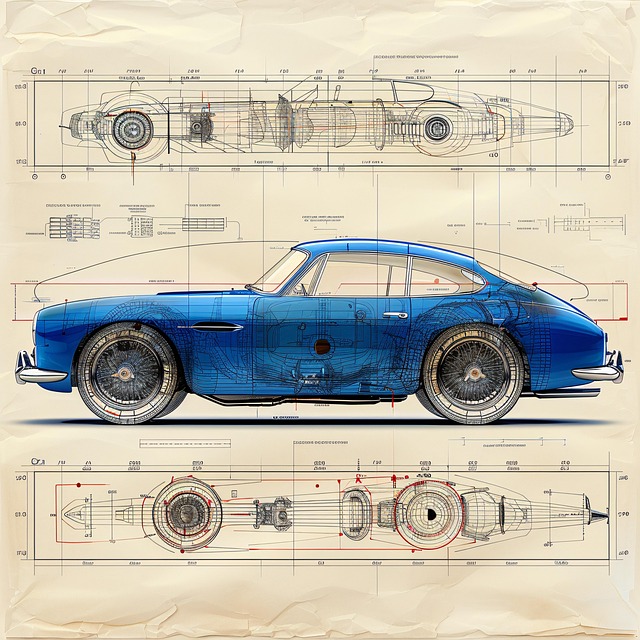

Car title loans are a type of secured loan where borrowers use their vehicle’s title as collateral. This option provides liquidity for low-income communities, offering a quick and accessible way to gain financial support. Often, traditional banking options are out of reach for those with limited income or poor credit, making car title loans an attractive alternative. These loans can help individuals cover unexpected expenses, such as medical bills or home repairs, or even serve as a means for debt consolidation.

By using their vehicle, low-income borrowers can access emergency funds without the stringent requirements typically associated with unsecured loans. This form of assistance is particularly valuable in challenging economic times, enabling individuals to navigate financial crises and potentially stimulate local economies as these loans are often circulated within the community.

The Role of Low-Income Assistance Programs in Economic Recovery

Low-income assistance programs play a pivotal role in economic recovery by addressing one of the most significant barriers to financial stability: access to capital. In many cases, individuals with limited income struggle to secure traditional loans due to strict credit requirements and high-interest rates. Car title loan low-income assistance programs bridge this gap by offering an alternative financing option. These initiatives recognize that everyone deserves a chance to improve their economic outlook, regardless of their current financial standing.

By leveraging the value of their vehicles through vehicle valuation, eligible participants can access quick funding without sacrificing ownership. This form of support keeps individuals and families in control of their assets while providing them with the means to meet urgent financial needs or invest in opportunities that could lead to long-term economic growth. The accessibility and speed of car title loan low-income assistance make it a powerful tool for fostering financial recovery and empowerment.

How Car Title Loan Support Can Drive Positive Change and Financial Stability

Car title loan low-income assistance programs offer a unique opportunity to drive positive change and financial stability for individuals facing economic challenges. By providing emergency funds through Dallas title loans, these initiatives empower those with limited credit options to access much-needed capital. This form of support can serve as a catalyst for personal growth and community development. Many low-income households struggle to cover unexpected expenses or urgent needs without the security of traditional banking services. Car title loan assistance bridges this gap by offering fast and accessible loans, often with flexible terms and no credit check.

Such programs not only provide immediate financial relief but also foster long-term economic recovery. With access to emergency funds, individuals can invest in education, start small businesses, or cover medical expenses, all of which contribute to their overall well-being and community prosperity. This proactive approach ensures that low-income families are equipped to navigate financial challenges, reduce reliance on high-interest debt, and build a more stable future.

Car title loan low-income assistance programs play a pivotal role in economic recovery by providing much-needed financial support to vulnerable communities. By offering quick access to cash using vehicle titles as collateral, these initiatives empower individuals to overcome short-term financial hurdles and work towards long-term stability. The positive impact extends beyond individual relief; it contributes to a stronger, more resilient local economy. This targeted approach ensures that low-income families can navigate challenging times, ultimately fostering a cycle of growth and improved well-being.